Bitcoin Forks

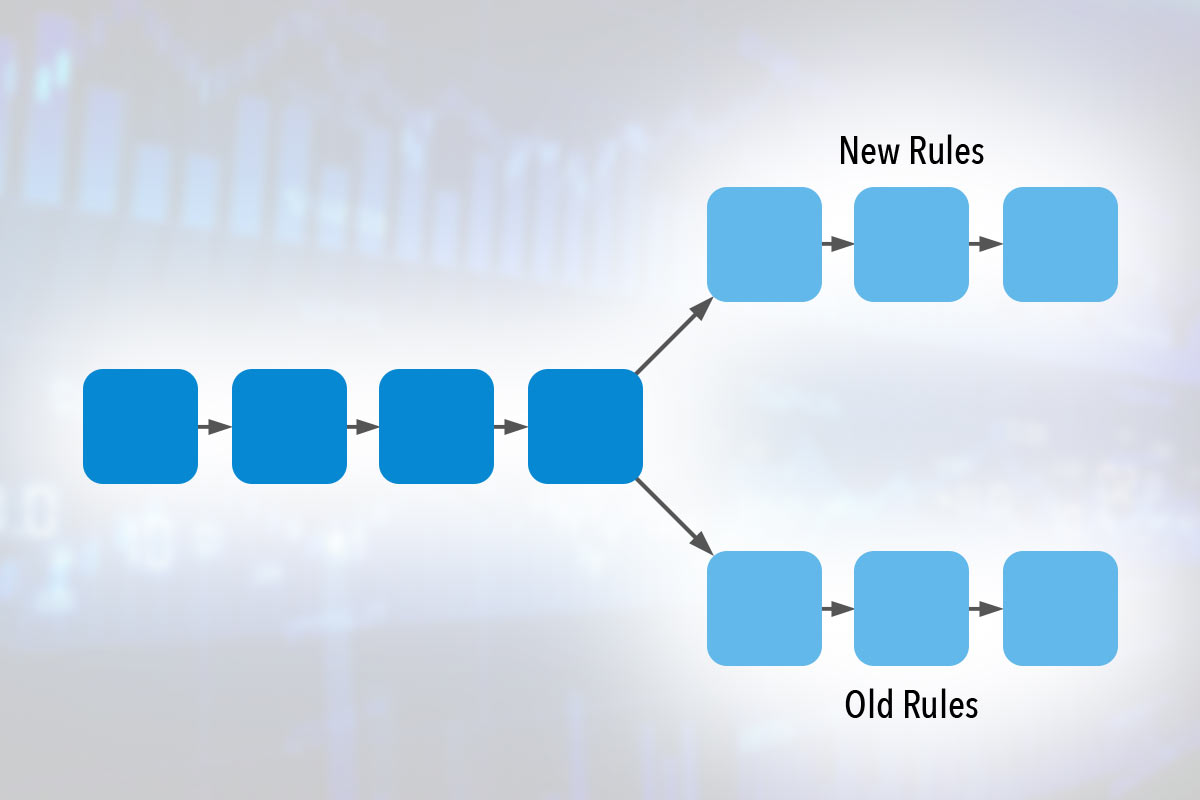

Bitcoin forks occur quite regularly, and they are nothing to be dismayed about. It means that the blockchain has reached a point where it can go in one of two directions, like a fork on the road. It is the users of the network that basically decide which of the paths (set of rules) to follow.

Most forks resolve in one direction or another on their own. But if there is a deep division within the community, and agreement on the way forward is not forthcoming, it can cause the network to permanently split and for two currencies to be born out of the original one.

What is a bitcoin fork?

A bitcoin fork is usually a technical event when two miners find a block at virtually the same time. The resultant ambiguity is resolved when future blocks are added to one or the other blockchain and everyone else follows suit. That blockchain wins out and the shorter, less popular chain is abandoned, or orphaned, by the network.

Forks can also be deliberately added or introduced to an otherwise stable network when network developers want to change the rules governing whether a transaction is valid or not. Some will want to stick with the existing rules, whilst others might want to go with the new rules.

Soft Bitcoin Forks

A soft fork occurs when the new rules are backwardly compatible with the existing network rules. This could be something simple like doubling the size of the blocks. The blocks are still resolved in the same way as they were before, just of a different size.

All nodes on the network will still see new transactions as being valid. However, if a node has not been upgraded to the new rules, the blocks that they mine will be rejected by those nodes which have upgraded. Thus, the upgrade needs the majority of hash power on the network to support it and to “win out”. If it doesn’t, then the new chain could become the shortest and therefore be orphaned.

Soft forks are regarded as less likely to disrupt, or split a network

Hard Bitcoin Forks

Hard forks are the opposite from soft forks. It means the proposed forward direction is not backwards compatible with the existing network rules. This usually occurs because of an expansion of the rules.

Nodes that adhere to the old rules will see new blocks as invalid and not add them to the chain. Similarly, blocks mined under the old rules will be seen as invalid (not matching the new, expanded rules). So, the incentive is to ‘upgrade’ and have the blocks they mined accepted and paid-for.

It is possible that an impasse occurs in the network, when there is an inherent disagreement about whether to go with the new rules or stick with the old. It doesn’t matter if one fork or the other has the majority of the hashrate as both forks will have its supporters and can thus splinter off in different directions.

User-activated bitcoin forks

These are forks that are not necessarily supported by the majority of miners on a network. Instead they are activated by exchanges, wallet providers or other businesses that run full nodes. They can decide on a new set of rules between themselves and implement them on their own software. People who want to continue using the products from those business are then obliged to adopt the new rules.

User activated forks occur on a specified date, agreed by the businesses involved. That gives all the node owners time to install the new software and prepare their systems for the switch.

Recent Bitcoin Forks

SegWit soft fork: A protocol upgrade that was introduced with the purpose of tackling the issue of scalability as well as malleability. This system segregates the signature data from other transaction data and camouflages the size of each block by converting bytes to units. The result is a block size of 1.8mb instead of 1. SegWit does not require any change to the existing Bitcoin protocol or software upgrade.

BIP 148 soft fork: this user activated fork was an attempt to force the miners to activate the aforementioned SegWit protocol. It became redundant when the miners chose to activate SegWit themselves via the BIP91 proposal.

SegWit2x hard fork: This proposal sought to increase the block size to 2 megabytes. Supporters of this upgrade were not satisfied with the SegWit compromise and preferred a hard fork that substantially increased block size. Due to the lack of consensus, the proposal failed to materialize.

UAHF hard fork: The user activated hard fork was a proposal that suggested a permanent divergence from the original blockchain and the creation of a new chain that includes blocks with much larger sizes. This proposal was the genesis of Bitcoin Cash and was well received by users opposed to SegWit’s separation of signature and transaction data.

What happens to my Bitcoins during a fork?

If you have one bitcoin when a fork happens, you end up with one bitcoin in both forks provided your exchange supports the new fork as well as the old one. If they don’t, you simply don’t receive the new token.

How does a fork affect the price of bitcoin?

The value of a bitcoin in fiat currency like dollars, euros or pounds, is set by “price discovery”, meaning the value is set at whatever buyers and sellers agree by matching supply and demand. So, the creation of a new coin or token does not directly affect the value of the old coin or token.

For example, if the value of one bitcoin was X thousand dollars before a fork. After the fork, buyers and sellers continue to try and trade the old coins. If they agree the value is still X thousand dollars, then that is what it is. There might be more buyers of the old coins in which case the fiat value will go up, or there may be fewer (perhaps because they are buying the new coin) and so the fiat value will drop below X thousand dollars.

What does not happen is the value of the old coin being shared between the old coin and the new coin.

Do I need to put my bitcoins on an exchange before a fork to get the new coins?

No. If you store your private keys on a hardware wallet, for example, you will always have access to both old and new coins by either waiting for the wallet to support the new coins or by transferring your funds to a different wallet platform that does support the new coin.

Will I be able to deposit or withdraw my bitcoins during a fork?

Most standard exchanges will usually inform their customers in advance as to what their position will be on a fork. This will include telling you if they will support the new token or not and any restrictions on trading during that period i.e. whether transactions are suspended for a short period of say 24 or 48 hours.