Limits of Supply

Bitcoin has fixed limits of supply, which means only a certain number of bitcoins will ever be available.

In the decentralized cryptocurrency space, there is no single central authority like the Federal Reserve or European Central Bank to regulate the money supply by printing more bank notes or taking them out of the system. Rather, the supply is limited by technical issues and the original design.

Bitcoin is created by the highly distributed nodes of a blockchain based peer-to-peer network spread across the world.

The generation-algorithm defines how the currency will be mined, following the consensus rules accepted by the entire peer network. Thus, Bitcoin supply is controlled collectively by the blockchain based consensus rules.

A new Bitcoin is created each time a block is discovered by miners using their computers to perform valuable calculations for the network.

21 Million Bitcoins Limit

The block creation rate is adjusted every 2016 blocks or approximately every fortnight. The number of Bitcoins generated per block decreases 50% every 210,000 blocks or four years approximately. Consequently, the maximum number of total Bitcoins cannot exceed 21 million; unless the Blockchain protocol is changed for augmenting the maximum Bitcoin supply.

The number 21 million corresponds to the 4-year reward halving time schedule; or the maximum capacity of a 64-bit floating point number. It is due to a technical limitation of the blockchain data structure; particularly, the integer storage type of the transaction output.

The average time of discovering a block varies depending on mining power as well as network difficulty; and so does the exact time of halving the block reward.

Thus, the time of last Bitcoin creation is not known exactly. Based on estimates of present Bitcoin mining power, you can expect mining of the last Bitcoin circa 2140.

Approximately 15 million Bitcoins have been mined already. The total spendable supply of Bitcoins is lower than the maximum possible total supply; due to accidental losses, destruction, and technical issues.

Bitcoin’s Fixed Supply - the New Gold Standard

Many users and investors espouse Bitcoin’s fixed supply like gold. Bitcoin’s fixed supply is celebrated by the supporters as a resemblance to the gold standard of money supply. But, some other users consider Bitcoin’s finite supply as an impediment to Bitcoin becoming universal currency.

- Bitcoin has gold-like similarities such as fixed supply and market determined prices.

- Bitcoin is mined out of digital Blockchain with hardware, like gold is mined out of the ground; and, thus, cannot be created out of the thin air in arbitrary quantities.

- Bitcoin offers additional benefits of being digital, totally weightless, easy to carry, and virtually costless to store.

Collapse of Bitcoin

Once 21 million Bitcoins are mined, the miners will not be able to reap the block rewards. Subsequently, the dependence only on transaction fees would make mining unsustainable; leading to a reduction in the number of miners, centralization of the network, and even collapse of the network in exceptional case. However:

- Mining technology and hardware may become more efficient in future; and, thus, reduce the mining costs and ensure the survival of miners on the transaction fees only.

- The transaction fees may also increase due to more transactions.

- The block size may also increase, enabling network scalability and lowering the cost of transaction confirmation.

Price of Bitcoin

The price of Bitcoin, in terms of regular currencies, showed phenomenal growth during 2017, scaling newer heights with almost each passing day.

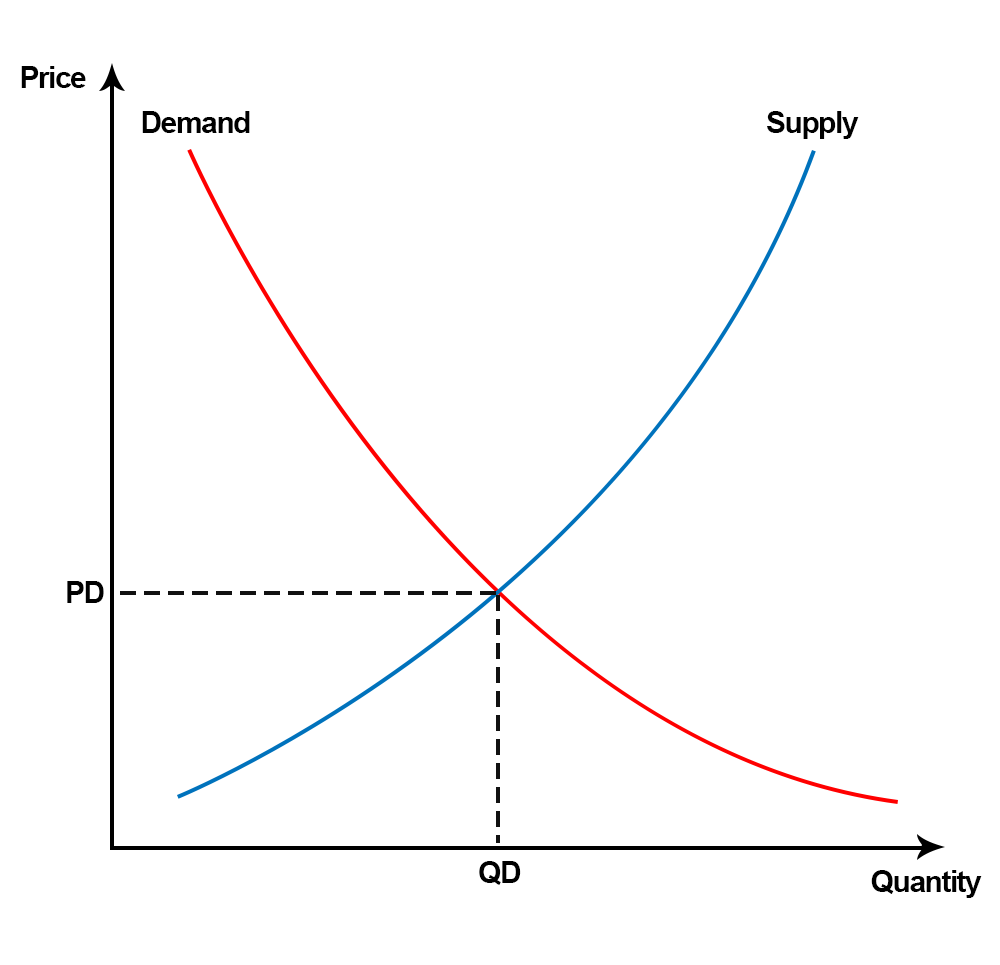

That price is expected to further increase as the rate of supply of newly mined Bitcoins slows down but demand goes up as more and more people become aware of the currency and regular banks start to hoard them to back their fund trading.

This mismatch between unprecedented demand and slow paced supply may take the price of Bitcoin to the extraordinary levels in the coming future.