Bitcoin Exchanges

Bitcoin can be swapped at any cryptocurrency exchange for traditional currencies like Dollars, Euros or Renminbi.

There are two types of cryptocurrency exchanges, regular and peer-to-peer.

Regular Bitcoin Exchanges

These are marketplace platforms, owned by third parties (intermediaries). You deal only with the Platform; it executes your transaction in the open market and a service fee is payable.

How do regular bitcoin exchanges work?

- register - credible platforms require personal, online verification.

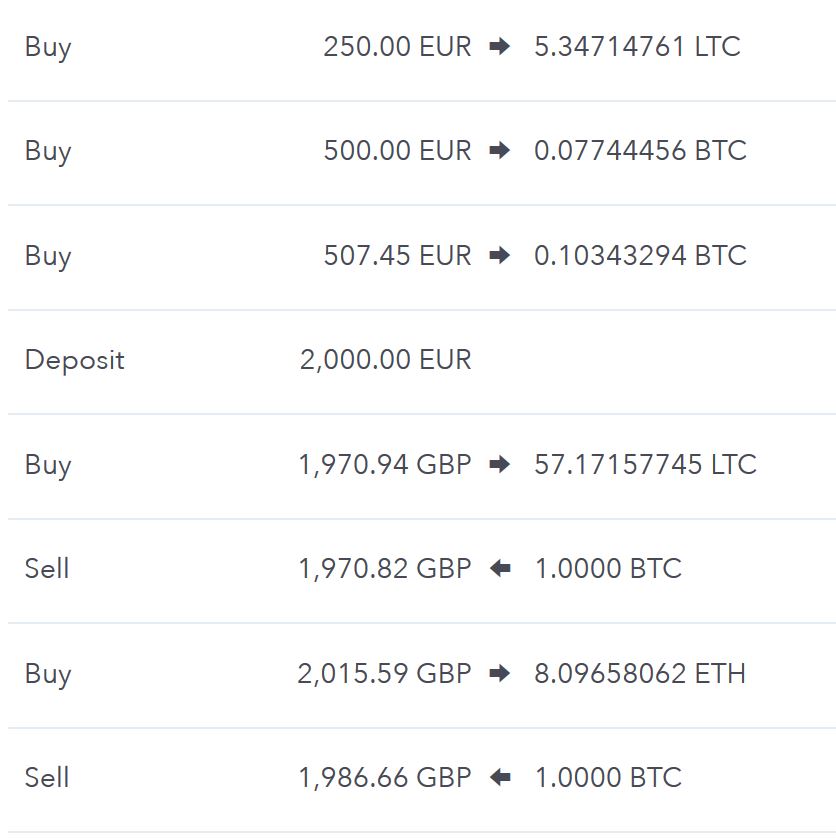

- fund your Bitcoin wallet – transfer Bitcoin in, or link your fiat bank account and purchase Bitcoin.

- trade Bitcoin – enter a buy/sell order on the platform; it updates the exchange’s common ledger called the order book; your order gets matched and your Bitcoin wallet adjusts automatically. A service fee is charged.

What are the key benefits of working through a regular bitcoin exchange?

- goodwill – you can verify an exchange’s credibility before signing up; build a personal relationship of trust, faith and even high-volume-discounts with the platform.

- finality – trades are final once executed; no buyer/seller conflicts afterwards.

- price discovery – your trade is executed at open-market values; peace of mind.

What are some of the downsides?

- fees – you pay for the services of the intermediary; rates vary around 1% of transaction value.

- vulnerability – your digital assets and personal information are held by the exchange; you may suffer loss if the platform closes down, gets hacked or is targeted by legislation (e.g. China).

Peer-to-peer cryptocurrency exchanges

P2P platforms merely connect you with potential counterparties for crypto trading; the rest is left up to you. Processes are fully digital and without intermediation, the core strength of Bitcoin’s design.

How do peer-to-peer bitcoin exchanges work?

- no registration or verification required – simply record your buy/sell order on the network.

- decentralized software connects potential counterparties.

- agree the transaction details and predefined steps.

- both parties pay a small Bitcoin “security” deposit into escrow; held by an independent third party (payment processor).

- parties fulfil the transaction steps.

- the payment processor refunds the escrow deposits; a small escrow fee is charged.

- if any party defaults, the transaction terminates fully; the deposit is awarded to the other party.

Key benefits of peer-to-peer bitcoin exchanges

- anonymity – no personal information is exchanged.

- decentralized process – no digital assets or info are retained; there is no risk of loss.

Possible downsides

- reduced liquidity – one-on-one focus; therefore market liquidity may be lower than regular exchanges; transactions take longer to match.

- lack of price discovery – transaction values are set by the parties, not by the market.

- chargeback fraud – unscrupulous operators may reverse credit card or Paypal payments for up to 30 days after the deal, leaving inexperienced parties out of pocket.

Crypto traders generally select the type of exchange most suitable to their specific purpose and objectives.

For high-volume traders, faster execution and price discovery are of prime importance; the use of regular exchanges may therefore be an appropriate choice.

Peer-to-peer exchanges on the other hand, is perhaps the better option for irregular and cost-sensitive crypto-market participants.