Coinbase Exchange Review

Founded in 2012, Coinbase is currently the world’s largest bitcoin exchange. The company currently accepts customers from 32 countries. Coinbase also allows users to trade Bitcoin and Ethereum on their Global Digital Market Exchange (GDAX).

Benefits of Coinbase Exchange

One of the primary reasons for Coinbase’s almost mainstream level popularity is the ease at which even those who are completely clueless about Bitcoin can make purchases. Here are a few other benefits you can expect when you do business with Coinbase:

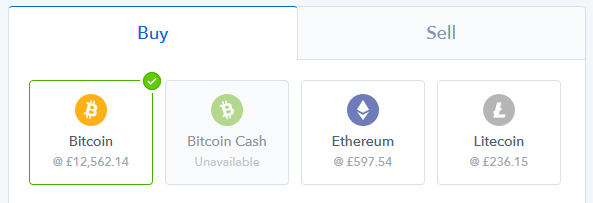

- The ability to purchase up to $1,000 worth of Bitcoin per week for verified credit card holders

- A nice variety of payment and withdrawal methods

- The ability to instantly transfer coins to other Coinbase users

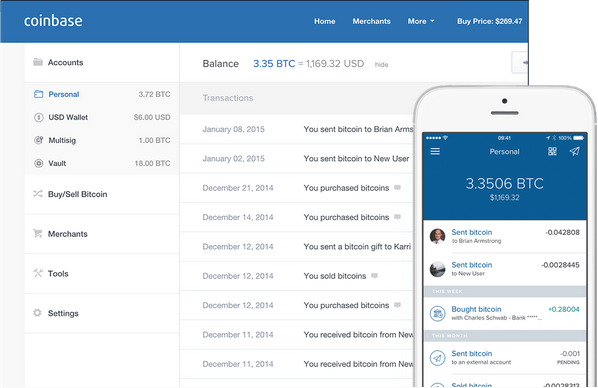

- A user-friendly platform

- A debit card that links to your BTC balance

- Multi-factor authentication

It’s impossible to overstress how easy Coinbase’s platform is. It’s on par with what you would expect when conducting online transactions with any of the major banks. It’s the most redeeming quality about Coinbase, one that none of its competitors come close to. That’s why Coinbase is typically the first place Bitcoin newcomers go to make their first purchase. It’s literally like any other transaction you do online – besides the fact they might ask you to upload a copy of your ID.

Coinbase’s decision to brand themselves as the first “square” cryptocurrency exchange has certainly paid off over the years. They’ve formed partnerships with many of the bigger banks, allowing them to accept and make payments via all the major credit cards, SEPA transfers, SWIFT, ACH, and PayPal.

Why cryptocurrency pros dislike Coinbase

While most in the crypto community will readily admit it is one of the best exchanges in the world for newcomers, there are several policies that the company has that have left many traders with the short end of the stick. Let’s take a look at a few reasons why you might want to consider other exchanges as your crypto portfolio grows.

1. Close ties with the system

Bitcoin was supposed to free us all! To keep us safe from greedy bankers who are always looking for new ways to squeeze a few more bucks out of us. Coinbase received over $106 million dollars in venture capital funding from 23 investors, including BBVA Compass Bank. Coinbase’s founder himself Fred Ehrsam worked for Goldman Sachs as a trader for years. His ethics are exactly what you would expect from a member of banking’s elite as he constantly looks for ways to implement traditional banking norms unto his platform.

2. The infamous ‘Freeze Notice’

If you’ve ever stumbled upon a rant against Coinbase online, it probably had something to do with someone getting their account frozen. Unlike most cryptocurrency exchanges, Coinbase prides itself on being legally compliant at all times. That means their security protocols are a lot similar to what you would expect from a traditional bank.

Be prepared to hand over personal information like your identification card or passport if you plan to do business with Coinbase. Policies like that are completely contradictory to what Bitcoin stands for in the first place. Part of the reason why cryptocurrencies are so popular nowadays is because it allows you to anonymously transfer funds anywhere in the world. Many of the major exchanges like Poloniex and LBC do not require you to hand over any identifying documents before you are able to make a purchase.

It doesn’t stop there.

The company tracks everything you do with your coins. Expect to have your account frozen if you send any payments to adult entertainment or gambling-related sites. Heck, Coinbase has even been known to freeze accounts for trading Bitcoin on other exchanges.

While Coinbase has a good track record of eventually releasing funds, who wants to deal with unnecessary holds and all the issues that come with it?

3. Disingenuous patents

Coinbase's bigwigs could be viewed as being as unethical as traditional bankers. The company has tried to patent common terms like “bitcoin exchange” and “hot wallet for holding Bitcoin.” Of course, the company claims they wouldn’t try to prevent others from using those terms if their application for a patent is approved.

Sure they wouldn’t…

Keep in mind we’re talking about a community where almost everything created is open source.

It’s moves like these that make people fear bitcoin will become just like everything else; controlled by The Establishment and big business.

4. Fork Issues

Coinbase made headlines in 2017 as the Bitcoin Cash fork approached. The company announced it wouldn’t provide its users with an equivalent amount of Bitcoin Cash after the fork (which is the norm when cryptocurrencies are forked), leading to an uproar from millions of users.

Coinbase eventually changed its tune after a few prominent legal experts made it clear the company had no right to confiscate its users’ Bitcoin Cash. Their users eventually got their Bitcoin Cash in January 2018, several months after every other major exchange has already sent theirs out.

5. Bad Exchange Rates

Coinbase holds a store of bitcoins and sells you BTC from the store, buying them back in from sellers. So you are not dealing direct with the vendors. This can mean that you do not get the best deal going. Bitcoins.net recently experienced this first hand when buying from Kraken and Coinbase at the same time: the exchange rate given to us by Coinbase was nearly 9% worse than that achieved on Kraken when the trades were only seconds apart.

Is Coinbase safe to use?

The likelihood of you waking up someday and discovering that all the Bitcoin held in your Coinbase wallet have vanished is rather slim, so in that sense it is safe.

However, there are better options like Poloniex and Bittrex if you are already familiar with how cryptocurrencies work. Many of these other sites didn’t create their trading platforms with the complete Bitcoin beginner in mind, so it’s easy to get lost on them if you don’t know what you’re doing.

If you think Bitcoins are something you can keep in your pocket, you’d probably be better off using Coinbase until you learn the ropes. Here are a few things you should keep in mind if you decide to go the Coinbase route:

- Never use Coinbase as your primary wallet

- Never make purchases from questionable vendors

- Be prepared to upload all your KYC and AML documents

- Send your cryptocurrency to a private wallet whenever a fork approaches